Will we soon see a recent, kinder and gentler Obama? It has responsible for taxes and expenses for the last four years replaced by moderate fiscal policy?

That’s certainly the White House’s view of the president’s recent budget. Let’s look at this topic, predictably turned in Washington Post Office report.

President Obama will release a budget next week that will propose significant cuts to Medicare and Social Security and fewer tax increases than in the past, a compromise approach… The document will take into account the compromise offer Obama made to Speaker of the House John A. Boehner (D-state) Ohio). ) last December during discussions on the “fiscal cliff” – which included reducing the deficit by $1.8 trillion through spending cuts and tax increases. …unlike the Republican budget that passed the House last month, Obama’s budget does not balance over 10 years.

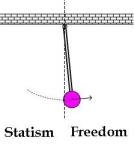

Because America’s fiscal challenge is overall government spending burdenI’m not too worried that Obama’s budget is unbalanced.

However, I wonder whether Obama is actually proposing a “reconciliation” budget. Will tax increases be smaller? Are the alleged spending cuts bigger?

There are actually no real spending cuts because the president’s budget is what it is based on unfair base budget planning. At best, we are simply talking about slowing government growth.

But since Mitchell’s golden rule is based on the very modest goal of slowing government growth relative to the private sector, it is possible that Obama is proposing something of value.

But possible is not the same as probable. Indeed, the budget appears to be based on a gigantic bait and switch, as the beneficial spending cap imposed by sequestration would be repealed!

Obama’s budget proposal, however, would eliminate sequestration.

This almost seems like an afterthought in a Washington Post article, but it should be the main story. The White House wants to get rid of it policies that actually limit spending growth.

We won’t know the official numbers until the budget is announced next Wednesday, but I’ll be very curious to see whether the alleged spending cuts elsewhere in his budget are more or less than the spending increases that will occur if sequestration is canceled. Especially since the president is also proposing a slew of recent spending on everything from early childhood education to brain mapping.

What’s more, Obama’s tax numbers also appear to be based on dodgy math. The White House says it is a “reconciliation” budget because it no longer proposes $1.6 trillion in tax increases.

The budget is more conservative than Obama’s earlier proposals, which called for $1.6 trillion in recent taxes and smaller cuts to health programs and domestic spending. Obama wants to raise $580 billion in tax revenues by limiting deductions for the wealthy and eliminating loopholes in certain industries such as oil and gas. These changes are on top of increased taxes on tobacco products and more circumscribed retirement accounts for the wealthy to cover the recent spending.

Let’s try to unravel the previous fragment. President wants $580 billion in recent taxes from ‘deductions’ and ‘loopholes’. But he also wants an unknown amount of revenue from recent tobacco taxes and IRA restrictions. And remember, he has already received $600 billion under the fiscal cliff.

We can’t say anything for sure until we get the official numbers, but on Wednesday I’ll be checking how much revenue the President expects to get from the tobacco and IRA regulations. Suffice it to say, I wouldn’t be surprised if the net impact of all his tax increases is close to $1.6 trillion. Especially since it also proposes manipulation of CPI data, which would generate another $100 billion in revenues.

In other words, the revenue side of his budget is likely to be a bait-and-switch scam, just as the spending side is a joke once you understand he wants to get rid of sequestration.

I hope I’m wrong, but I fear that next Wednesday my fears will be confirmed and we will see another budget that will not have real reform of entitlements and more tax increases for class struggle.

PS The budget approved by the House of Representatives avoided tax increases and by limiting expenses, it will grow by an average of 3.4%. annually. Not exactly draconian, but that’s the approach will balance the budget within 10 years.