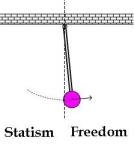

Ladies and gentlemen, the pendulum is swinging in the right direction.

In recent weeks, I have shared many examples that support my hypothesis that libertarians, small-government conservatives, and classical liberals are finally making some progress.

This trend actually started with the fiscal cliff, even though it was just a problem smaller than expected failure.

Since then, we have enjoyed victories on the pitch isolate, IMFAND energetic scoring. I have also posted evidence showing that the The Tea Party made a positive difference and specifically released data showing that the burden of government fiscal policy has declined since the 2010 election.

Well, here’s another feel-good story. The powerful House committee chairman realizes that being pro-market is not the same as being pro-business. Alleluia!

The Wall Street Journal reports: :

During Jeb Hensarling’s first run for Congress, a man on the campaign trail in Athens, Texas, asked the Republican if he was “pro-business.” “No,” the candidate replied, drawing curious glances from local business leaders who gathered to hear him speak, recalls a former Hensarling aide. “I am not a supporter of business. I am a supporter of free enterprise.” Now, more than a decade later, that distinction is winning over Wall Street. The recent chairman of the House Financial Services Committee wants to reduce taxpayer exposure to banking, insurance and mortgage lending by relaxing government control over institutions and programs on which the private sector depends, from mortgage giants Fannie Mae and Freddie Mac to flood insurance. Banks and other gigantic financial institutions are particularly concerned because Mr. Hensarling plans to push for regulations that could require them to hold much more capital and establish recent barriers between their federally insured deposits and other activities, including commercial and investment banking. …In interviews, half a dozen industry representatives expressed some level of concern about Mr. Hensarling’s legislative agenda.

So cronyists are “on edge” and feel “anxiety.” Oh my, it just breaks my heart.

And it’s not just MP Hensarling who sings from the appropriate repertoire.

Earlier this month, all 45 Senate Republicans voted for a symbolic measure targeting banks with more than $500 billion in assets. The amendment proposed by Sen. David Vitter (R., Los Angeles) and Sherrod Brown (D., Ohio) aimed to eliminate any subsidies or other benefits that benefit the largest financial institutions because investors look to the government to prevent their collapse. …Most Republicans in Congress believe that changes made in the wake of the 2008 financial crisis – mainly the Dodd-Frank Financial Reform Act – reinforced the view that the largest institutions were “too big to fail” because they ensured that the government will step in to prevent the collapse of the most developing companies.

It is true that many of these same politicians voted for TARP, so I have no illusions that they have become staunch supporters of true capitalism.

Putting taxpayers against Wall Street

Even though Hensarling did vote the right way, I’m sure he understands it insolvent banks should be liquidated rather than rescued.

Pity people in the Bush administration didn’t understand this uncomplicated principle of the free market.

Here are more details from the article about Hensarling’s commitment to economic freedom.

Hensarling has been a vocal critic of taxpayer protection mechanisms in the private sector. In the fall of 2008, he voted against the Wall Street bailout and supported measures to make it easier to import prescription drugs. He even got into a fight with one of the largest employers in his backyard, American Airlines, in support of initiatives to allow more long-haul flights from Love Field in Dallas, the home base of rival Southwest Airlines. Currently, its other potential targets include: the Export-Import Bank of the US, which provides loans to U.S. companies doing business abroad, and the Terrorism Risk Insurance Act, a fleeting protection created after 9/11 to insure construction projects. This latest measure expires at the end of 2014 unless Mr Hensarling’s committee takes action to extend it. “In every jurisdiction I can get my hands on, I want to move us away from the Washington insider economy,” he said. Hensarling sharpened his free-market views while studying economics under former senator Phil Gramm at Texas A&M University.

I’m especially glad he wants to finish corrupt subsidy system from the Export-Import Bankwhich is a typical example of gigantic enterprises’ opposition to the free market.

What does all this mean? Perhaps not much in the miniature term, especially with Obama in the White House and Tim Johnson of South Dakota chairing the Senate Banking Committee.

In the long run, however, this is a positive signal. Our prosperity and freedom depend on it diminutive government and free marketsthat’s why we need at least some legislators who understand that gigantic interest groups should not be favored.