I wrote several posts comparison of Reaganomics and Obamanomicsmainly based Minneapolis Federal Reserve data on employment and economic performance.

I even did it TV interview on this topicwhich prompted some comments about my taste in clothing as well he quoted Richard Rahn’s column it got it Paul Krugman and Ezra Klein upset.

Some of the best evidence about high and low tax rates comes from America. Art Laffer (yes, that Art Laffer) and Steve Moore have great column in today’s Wall Street Journal. It’s sort of Reaganomics versus Obamanomics, looking at the evidence from the states.

Barack Obama is asking Americans to bet that the American economy can be taxed and made prosperous. …You. Obama needs a reminder of the 1920s, 1960s, 1980s and even 1990s, when government spending and taxes fell and employment and incomes rose rapidly. But if the president wants to see fresher evidence about the importance of taxes, he could look to what’s happening in the 50 states. In our recent report, “Rich States, Poor States,” prepared for the American Legislative Exchange Council, we compare the economic performance of states with no income tax to that of states with high rates. It’s like comparing Hong Kong to Greece… Every year for the last 40 years, states with no income taxes have seen faster output growth (measured on a decadal basis) than states with the highest income taxes. For example, in 1980 there were 10 states with zero income tax. In the decade to 1980, these states grew 32.3 percentage points faster than the 10 states with the highest tax rates. Job growth was also much higher in zero-tax states. States with the nine highest income tax rates saw no net job growth at all, and seven of those nine experienced job losses.

Tax rates also lead people to “vote with your feet” Laffer and Moore look at migration patterns.

Over the past decade, states without an income tax experienced population growth that was 58% higher than the national average and more than twice that of states with the highest income tax rates. …Illinois, Oregon and California are state practitioners of Obamanomics. All have passed laws that encourage the wealthy, such as the Buffett Rule (and economically damaging regulations such as California’s Cap and Trade Program), and all face immense deficits as their economies continue to shrink. Since tax rates increased in January, Illinois has lost one resident every 10 minutes. California has 10.9% unemployment and has lost 4.8% of its jobs over the last decade. …Every time California, Illinois, or New York raise taxes on millionaires, Florida, Texas, and Tennessee see an influx of wealthy people buying homes, starting businesses, and making purchases into the local economy.

Competition among states is prompting some states to make further improvements. Some are even trying to get rid of income tax.

Republican governors in Florida, Georgia, Idaho, North Dakota, South Carolina, Ohio, Tennessee, Wisconsin, and even Michigan and New Jersey are cutting taxes to attract recent businesses and jobs. When asked why he wants to lower the cost of doing business in Wisconsin, Governor Scott Walker replies: “I’ve never seen a store get more customers by raising prices, but I’ve seen customers break down doors by lowering prices.” Georgia, Kansas, Missouri and Oklahoma are currently racing to become the tenth state in America with no income tax.

I like Governor Walker’s quote. It seems so know what he’s talking aboutso it will be engaging to see if he survives the upcoming recall election. I think it depends on voters understanding that substantial government and high tax rates are a recipe for continued decline.

Some states, such as Illinois AND Californiaare filled with voters who refuse to acknowledge reality. Think of them as Greece and Spain in America, perhaps because the number of tax consumers is greater than the number of tax producers.

And although Parasites should understand that there is no point in killing host animals, this cartoon illustrates how welfare states lure more and more people into riding the wagon. AND this cartoon shows the consequences of too many bums and not enough producers.

One of my first blog posts in 2009 included a column about The Social Security Administration squandered $750,000 at a “conference” at a luxury golf resort in Arizona.

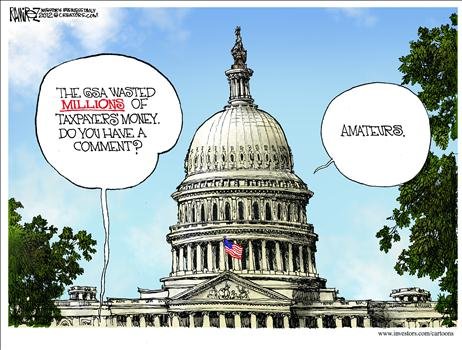

That’s why I’m not surprised that GSA pissed away a lot of money at a Las Vegas resort. This is what people do when they spend other people’s money. Cholera, this drawing shows it better than I can express.

Here is a tiny sample of similar atrocities.

The bureaucrats involved in all these attacks should be fired and maybe even charged with crimes such as fraud, but this cartoon reminds us that the real problem is the political class that appropriates money that is then wasted by the bureaucracy.

The author of this cartoon is Michael Ramirez and you may know that he is one of my favorites. To understand why, see Here, Here, Here, Here, Here, Here, HereAND Here.

And this cartoon reminds us that every dollar of waste that gets publicized is just the tip of the iceberg.

I don’t know Steve Breen, but he does a lot of work like this. I’m sure I’ll be showing more of his cartoons.

It’s a bit depressing to think about all this waste, fraud and abuse, so let’s try to feel better by thinking about how foreign governments waste taxpayers’ money, for example the UK government funds sex trips to Amsterdam, Greek government rewards pedophiles with disability benefitsor The European Commission is funding penile implants for senior politicians and bureaucrats.